Your central entry point to cash register data.

Be prepared for a cash register audit by the tax authorities

Transform the challenge of fiscal data archiving into a competitive advantage! With POS Comply, you get a fully GoBD and KassenSichV compliant solution in the SAP® BTP cloud, securely storing your data in Germany.

The installation of a Technische Sicherheitseinrichtung (Technical Security Device; TSE) certified by the BSI is only the first step toward audit-proof cash data archiving. The collected TSE data must be stored, analyzed, and processed in accordance with requirements.

In the worst-case scenario, you could be archiving incomplete and incorrect data, which cannot be regenerated or provided later! With POS Comply, you ensure that your data is archived correctly and completely. We help you avoid data loss and always have an answer ready when the tax authorities come knocking.

Why poscomply?

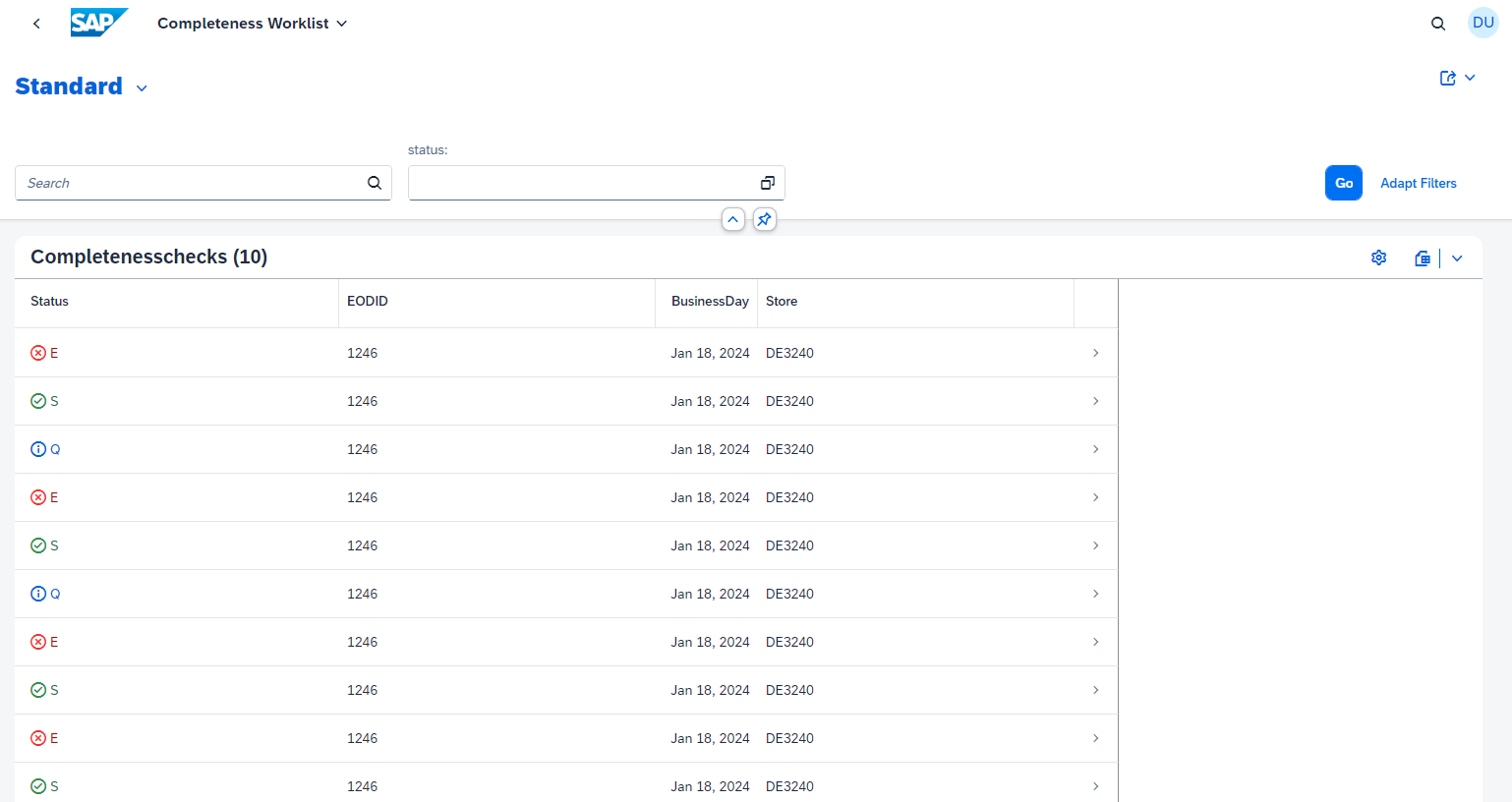

Modern monitoring

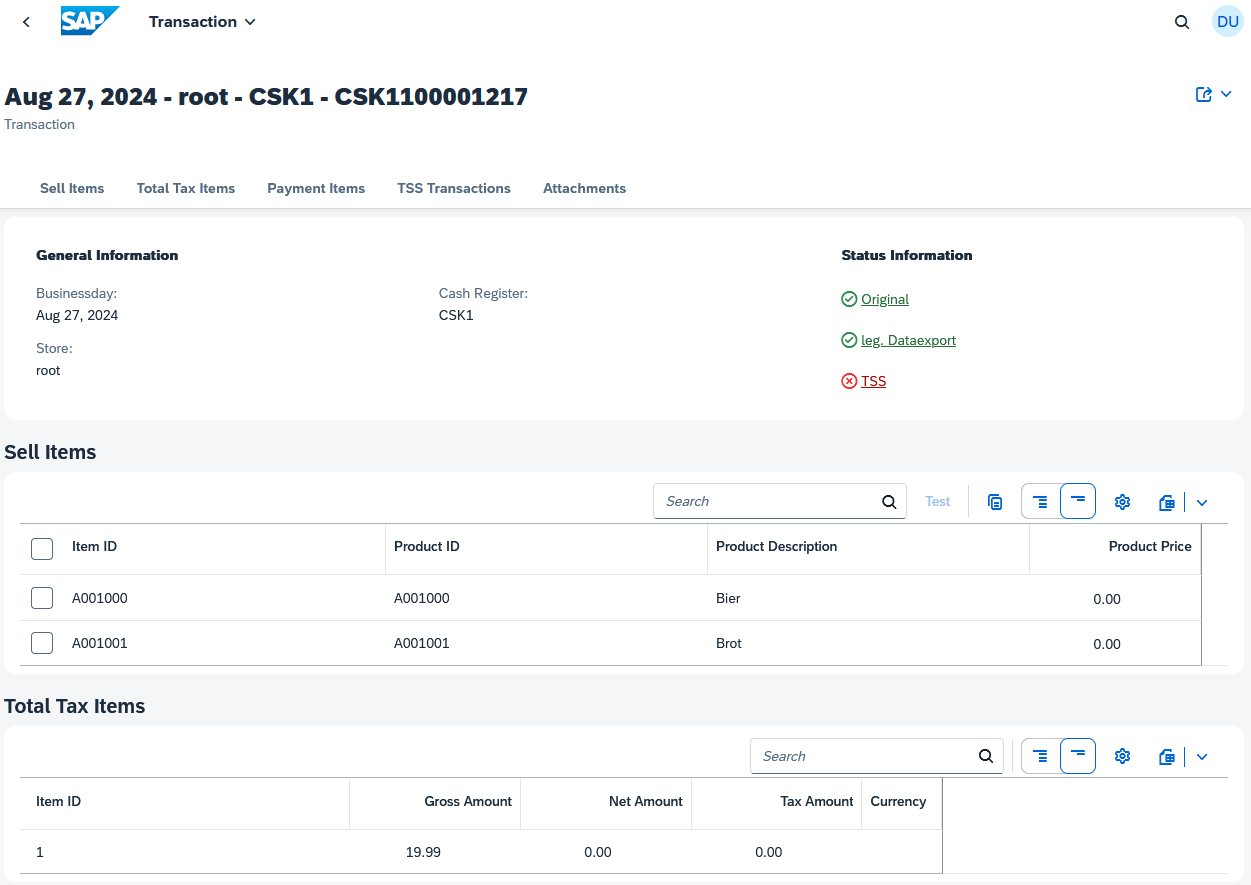

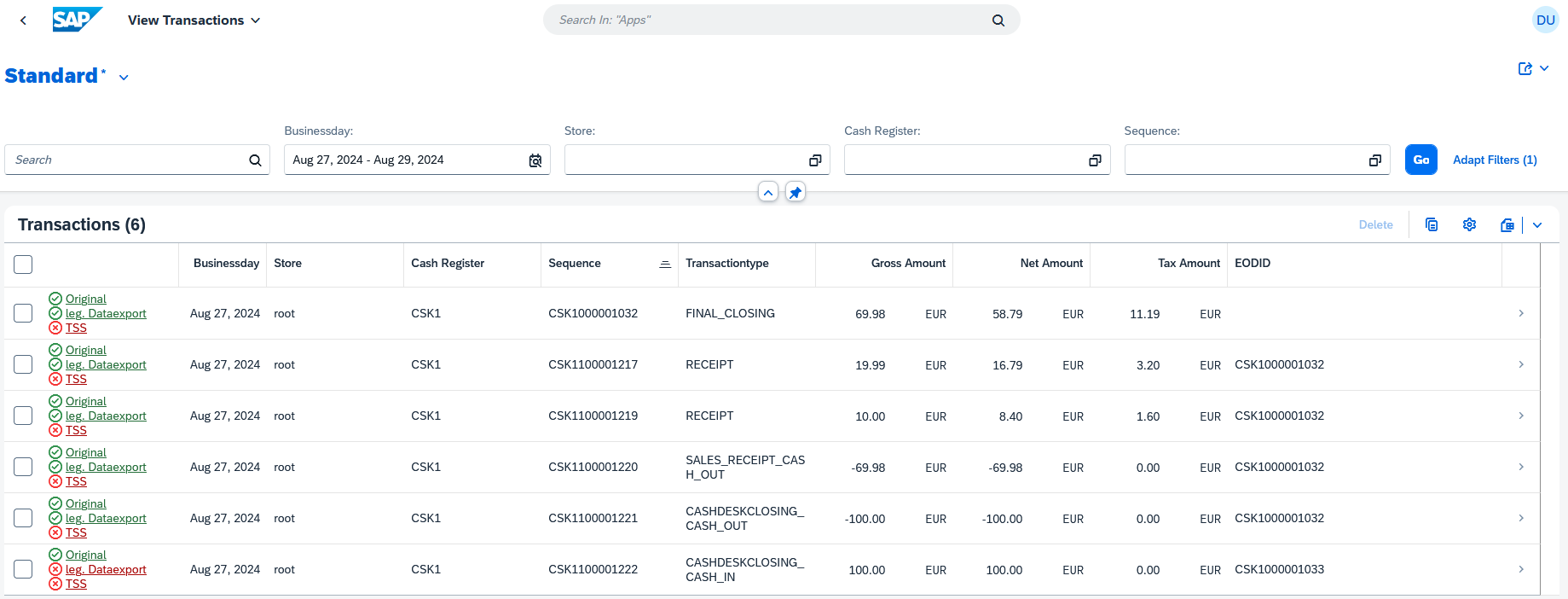

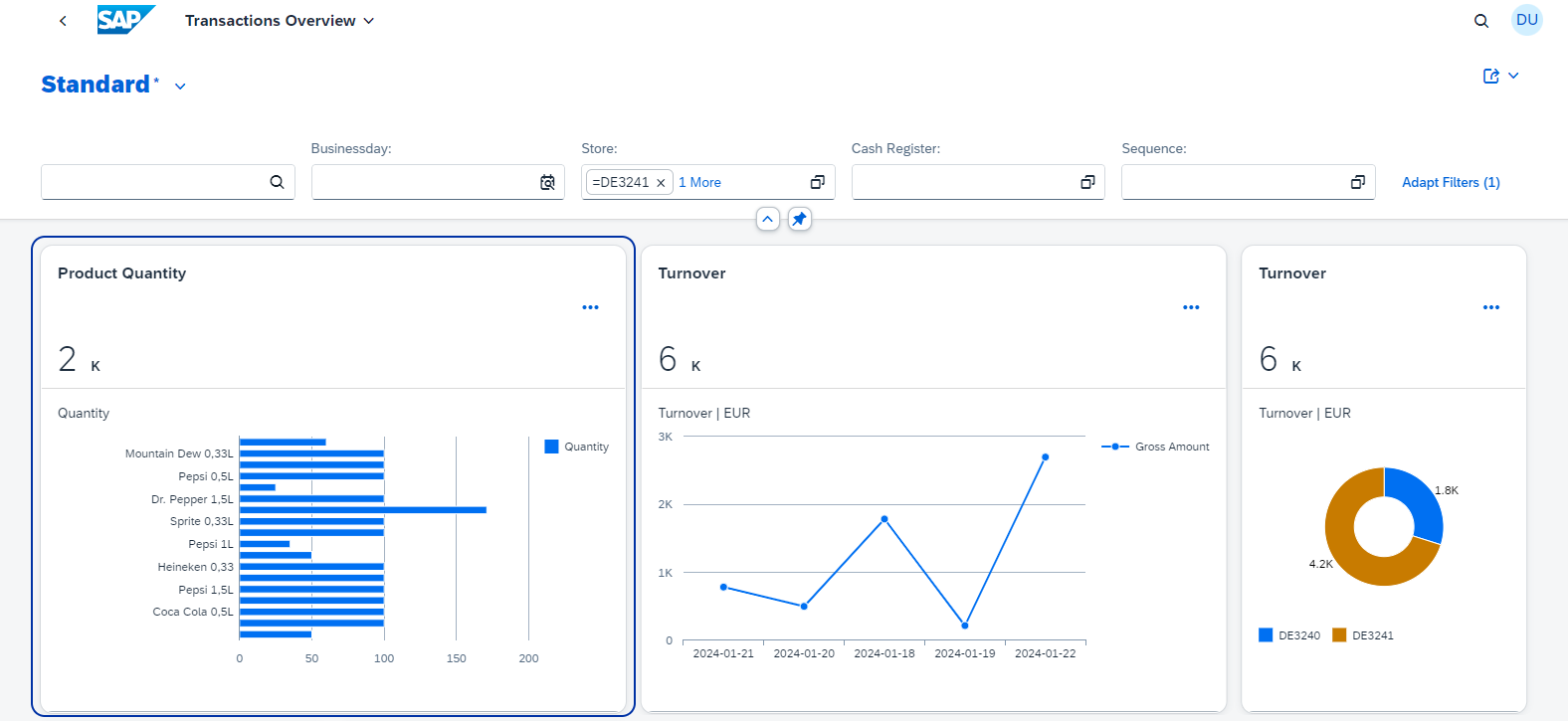

Keep an eye on all cash transactions and fiscal data at all times – from recording to archiving.

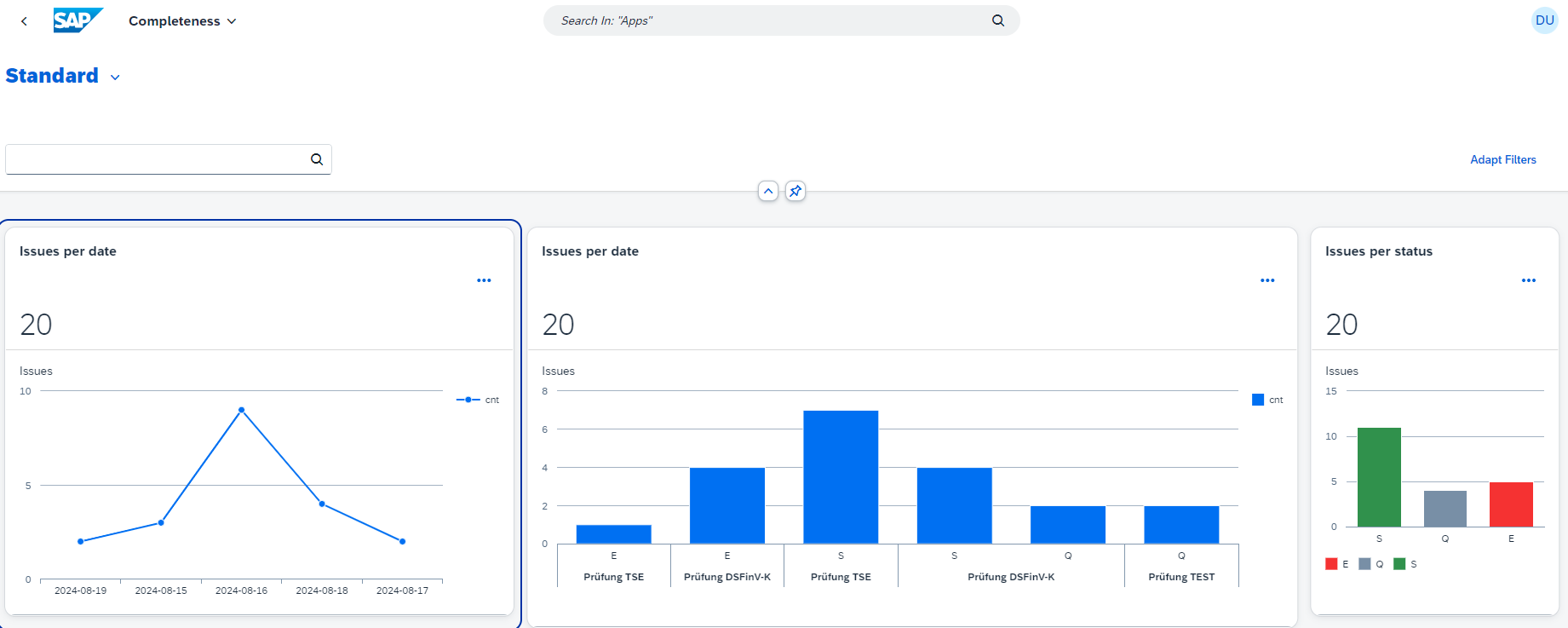

Dashboard & issue management

Intuitive dashboards and integrated task management support you in proactive monitoring and troubleshooting.

Audit-proof archiving

Your data is stored securely and can be audited at any time.

Connection to cloud TSE

Seamless integration into existing cloud technologies with the option of expansion by cloud TSE or hardware providers.

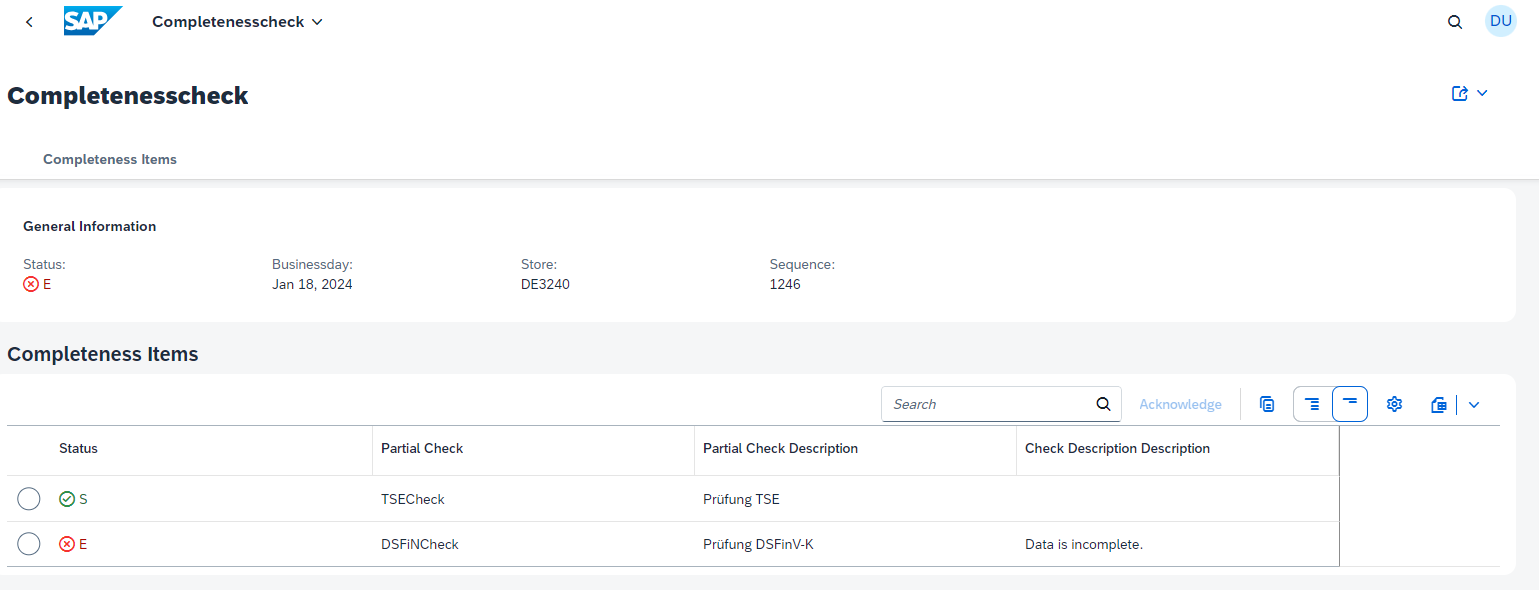

Audit simulation & completeness check

You can simulate whether your data is correct and complete in advance of an audit.

Compliance security

Avoid sanctions and ensure that your tax obligations are met in full.