Ihr zentraler Einstiegspunkt zu den Kassendaten.

Bereiten Sie sich auf eine Kassenprüfung durch die Steuerbehörden vor

Verwandeln Sie die Herausforderung der steuerlichen Datenarchivierung in einen Wettbewerbsvorteil! Mit POS Comply erhalten Sie eine vollständig GoBD- und KassenSichV-konforme Lösung im SAP®. BTP Cloud und speichert Ihre Daten sicher in Deutschland.

Der Einbau einer Technischen Sicherheitseinrichtung (TSE), die vom BSI zertifiziert ist, stellt lediglich den ersten Schritt dar, um Kassendaten revisionssicher zu archivieren. Die gesammelten TSE-Daten müssen anforderungsgerecht gespeichert, ausgewertet und verarbeitet werden.

Im schlimmsten Fall archivieren Sie unvollständige und falsche Daten, die Sie später nicht mehr zurückgewinnen oder bereitstellen können! Mit POS Comply stellen Sie sicher, dass Ihre Daten korrekt und vollständig archiviert werden. Wir helfen Ihnen, Datenverluste zu vermeiden und haben immer eine Antwort parat, wenn das Finanzamt anklopft.

Warum POScomply?

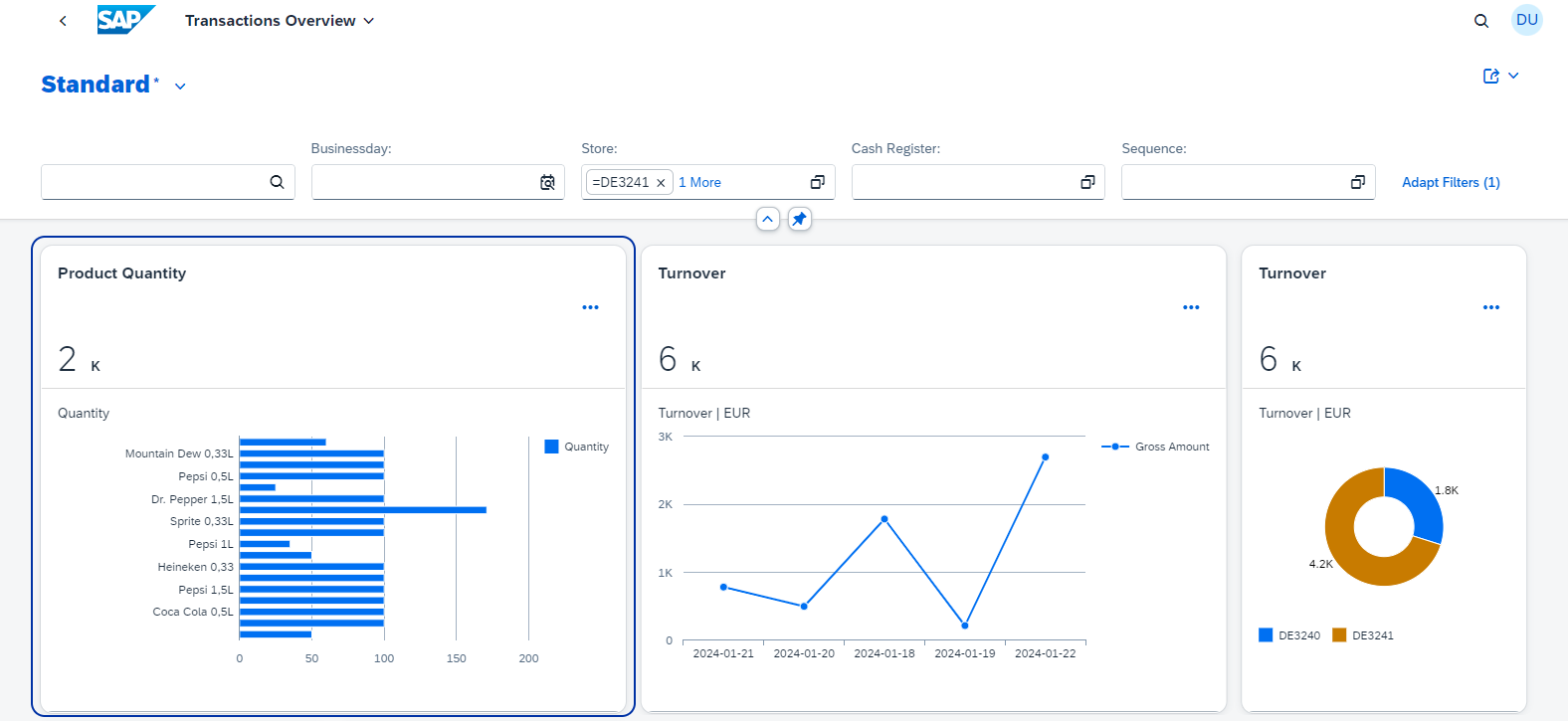

Moderne Überwachung

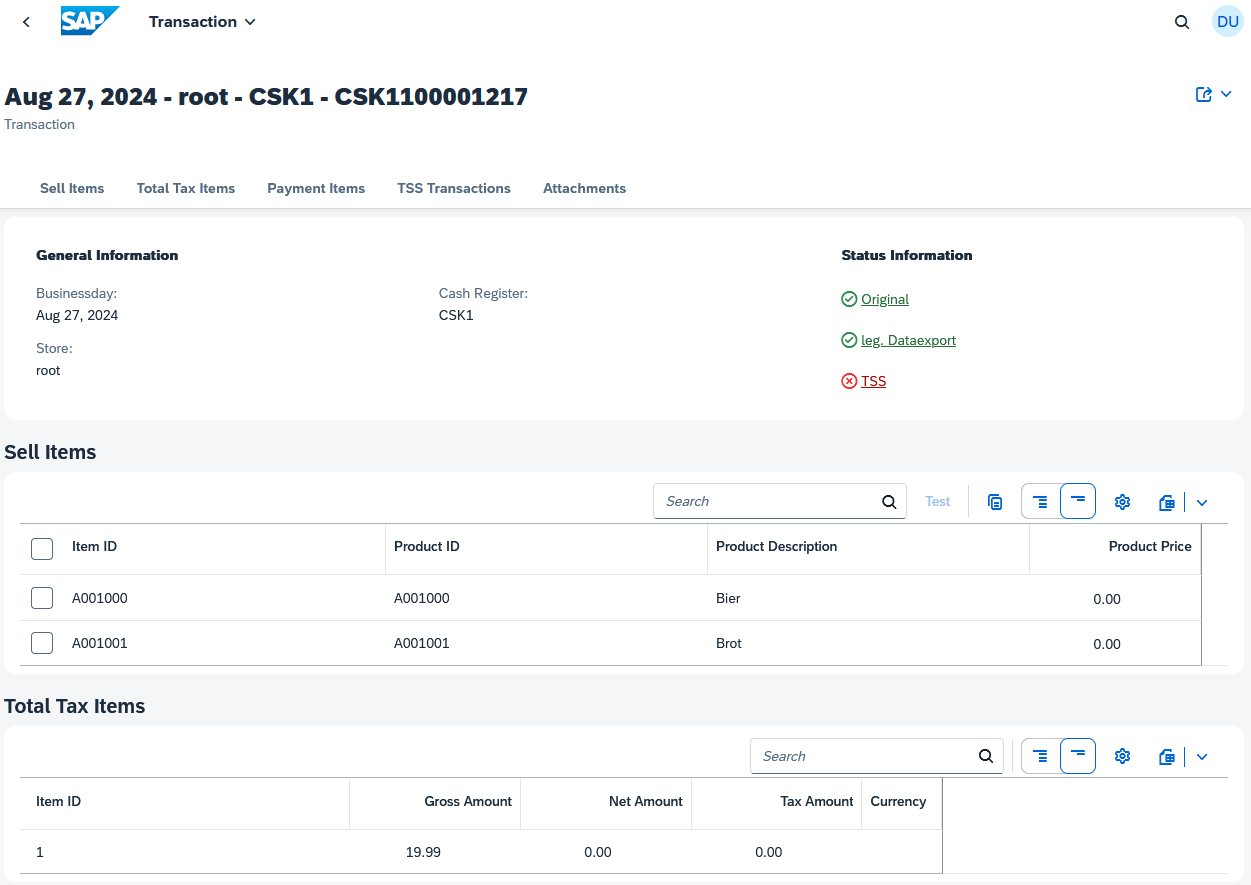

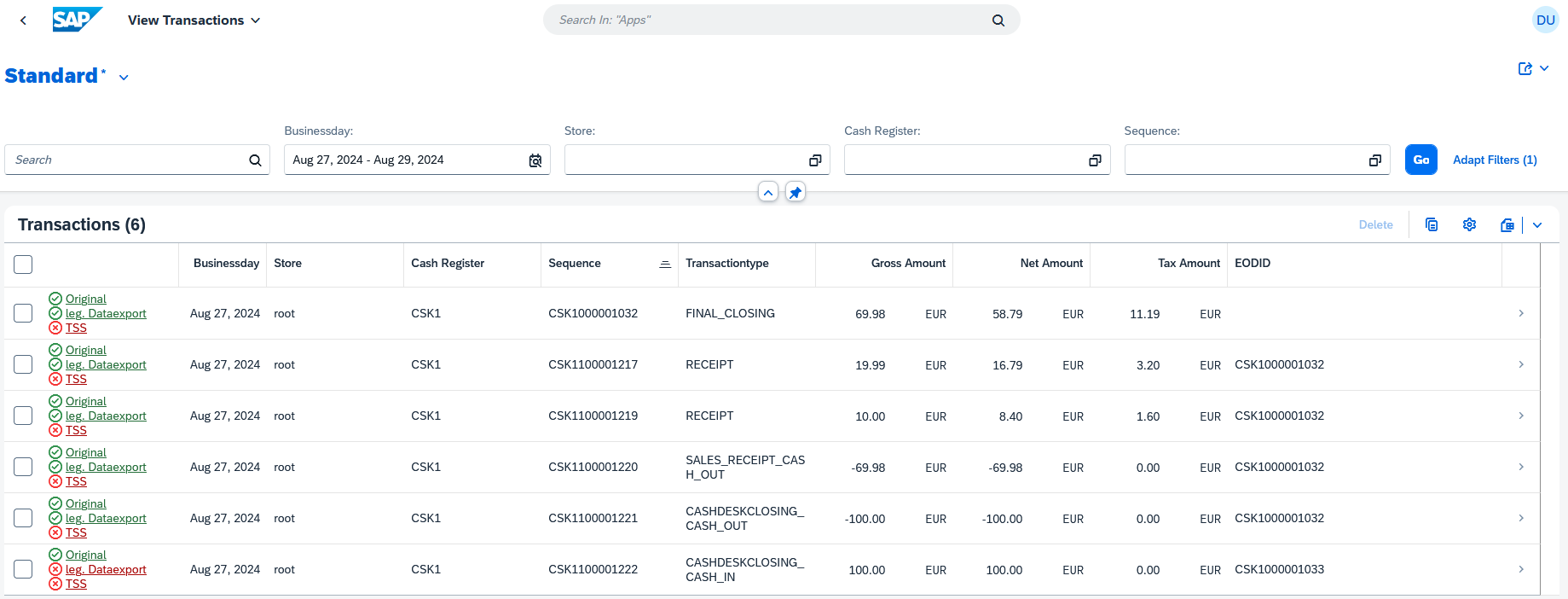

Behalten Sie alle Bargeldtransaktionen und Steuerdaten jederzeit im Blick - von der Erfassung bis zur Archivierung.

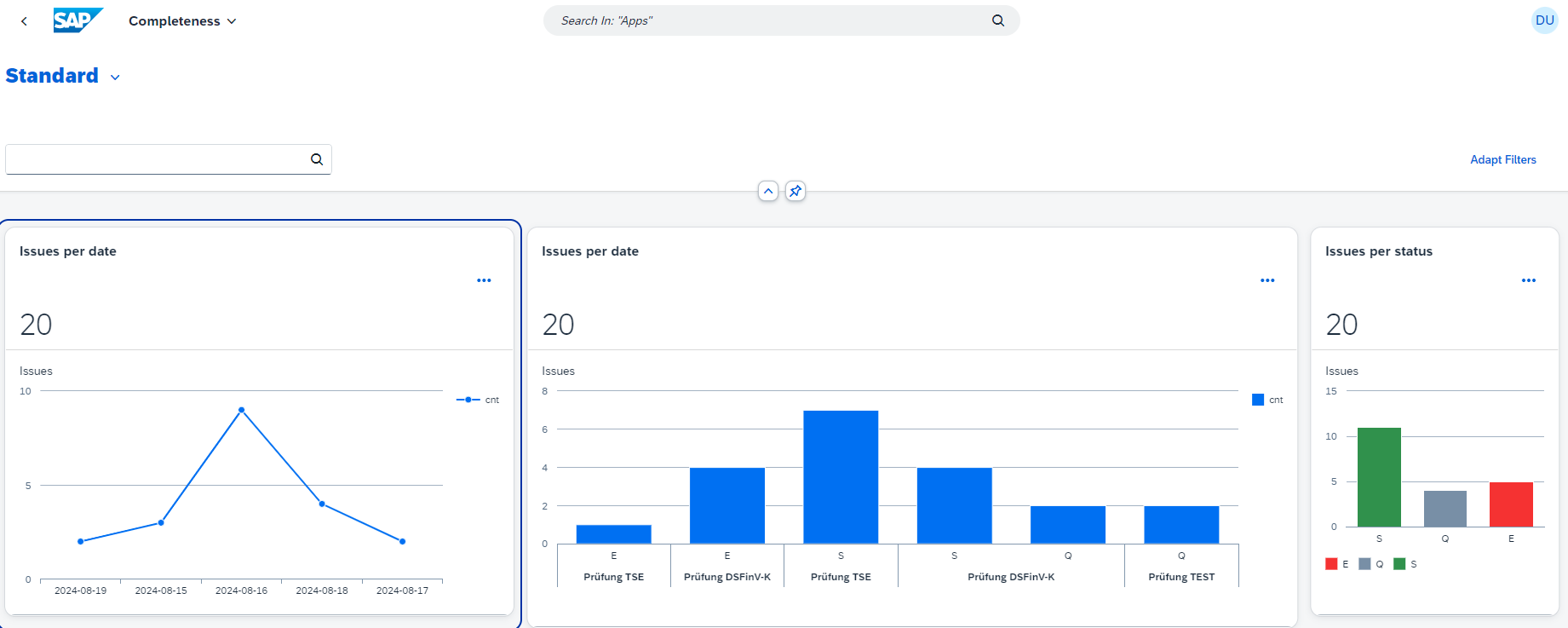

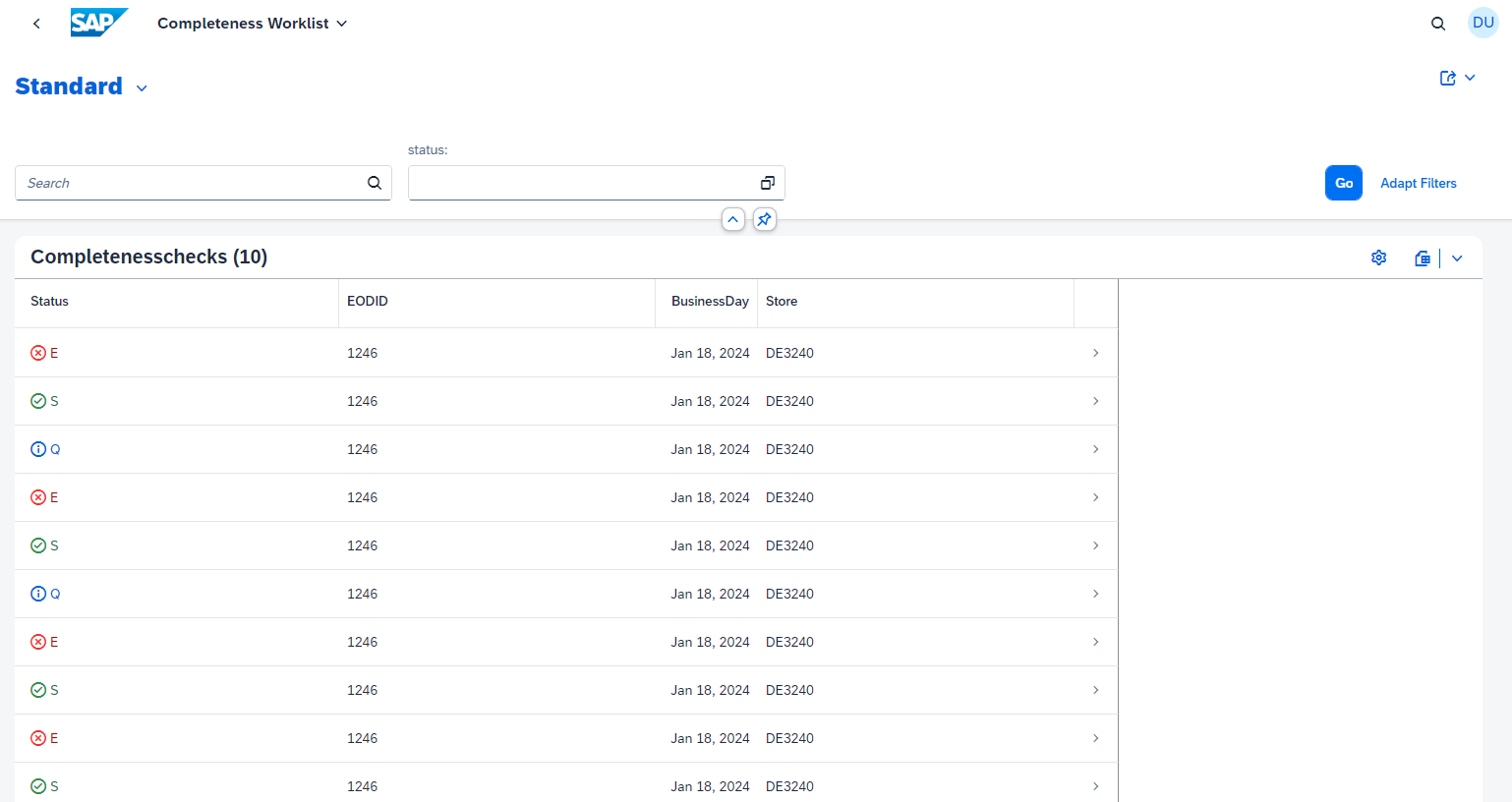

Dashboard und Problemverwaltung

Intuitive Dashboards und integriertes Aufgabenmanagement unterstützen Sie bei der proaktiven Überwachung und Fehlersuche.

Revisionssichere Archivierung

Ihre Daten werden sicher gespeichert und können jederzeit eingesehen werden.

Verbindung zur Cloud TSE

Nahtlose Integration in bestehende Cloud-Technologien mit der Möglichkeit der Erweiterung durch Cloud-TSE oder Hardware-Anbieter.

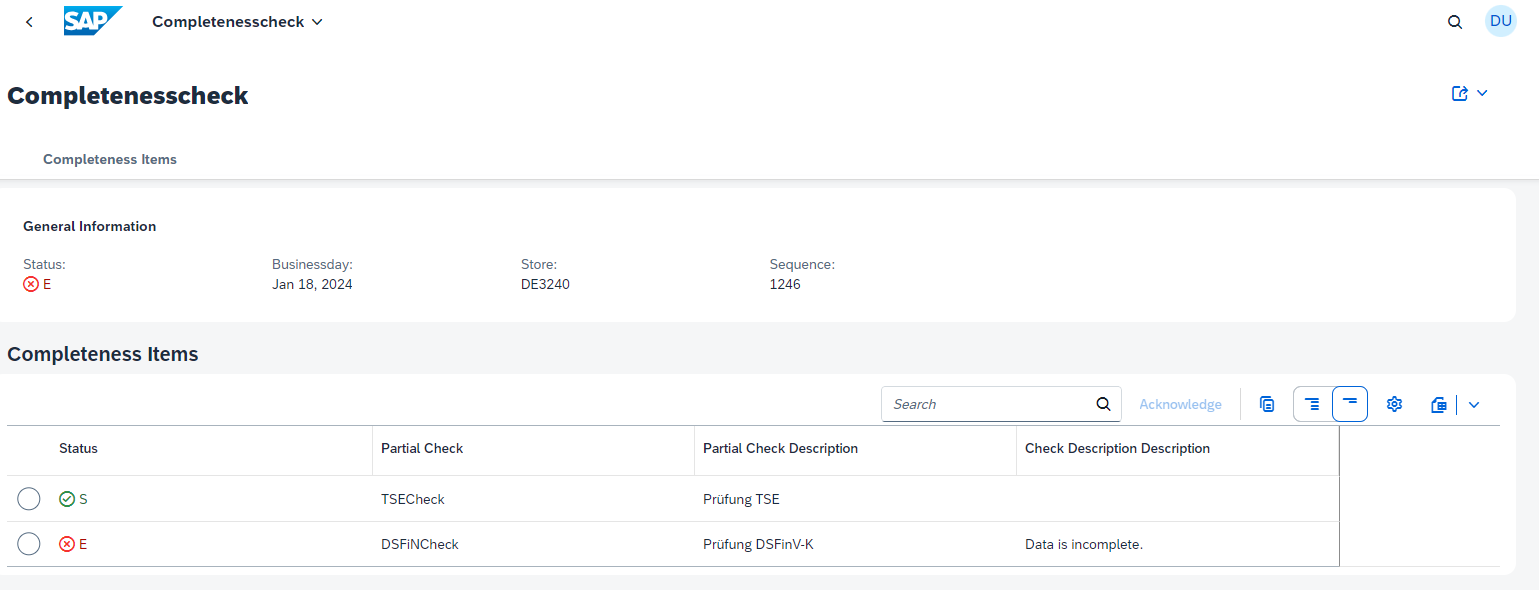

Audit-Simulation & Vollständigkeitskontrolle

Sie können im Vorfeld einer Prüfung simulieren, ob Ihre Daten korrekt und vollständig sind.

Sicherheit bei der Einhaltung von Vorschriften

Vermeiden Sie Sanktionen und sorgen Sie dafür, dass Ihre steuerlichen Verpflichtungen vollständig erfüllt werden.